A good stock screener may quickly find the stocks that fit your unique criteria and complement your investment plan by sorting through the thousands of stocks listed in the United States or the tens of thousands listed globally.

The more you use a stock screener, the better results you get by reducing your options to the best investing prospects.

At the time of selecting the ideal stock for your investment approach, individual investors are normally dependent on the experts for good stock selection because they have the tools and a strong team of analysts to dig through mountains of data and the large universe of stocks.

Unless you have access to a reliable stock screener who can do the work for you, it’s probably wise advice.

Here are the top picks:

Best Stock Screeners

- ZACKS (NASDAQ)

- Trade Ideas

- TC2000

- FINVIZ

- TradingView

ZACKS (NASDAQ)

A thorough stock screener solution with great functionality and a vast array of metrics is available from Zacks Investment Research. We chose Zacks as the best free stock screener because the free edition provides sufficient capabilities for thorough and intelligent stock filtering.

Pros

- Comprehensive free stock screener

- Thousands of basic metrics

- broad stock database

- Numerous EPS metrics

- Low-cost paid strategy

Cons

- Only light technical examination

For investors seeking a competitive edge in stock selection, Zacks’ free stock screener provides practically all of the information required to make well-timed and knowledgeable stock selections. Zacks has established a reputation as a trustworthy source of stock data. Because of this, Zacks is our pick for the best free stock screener.

Users can set their own segmentation criteria, which is one of Zacks’ primary benefits in addition to the hundreds of indicators it offers. You can increase your chances of getting accurate screening results by using a standard figure or range as a filter. The extensive earnings per share (EPS) data is another noteworthy feature that lets you dig further into a company’s performance according to its EPS history.

The free plan offers access to all of its more sophisticated features except for a few. With a Zacks Premium membership, you may explore further with more than 45 predefined screens or utilize the Custom Screener, which displays the top Zacks Rank stocks based on your individual preferences and trading style, such as value, growth, momentum, or income. With a free 30-day membership, you may test out Zacks Premium Screener as well as several other potent tools and resources.

Trade Ideas

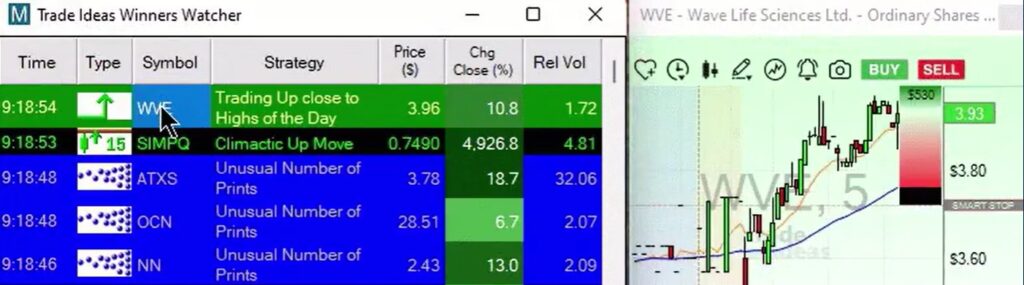

This is one of the best screeners for day trading. Trading Ideas tops our list of the best stock screeners for day trading thanks to its blazing-fast platform and AI-driven functionality for screening hundreds of criteria.

Pros

- AI stock screener with several features

- incorporating brokerages

- Adaptable screens

- Actual trading room

Cons

- Only functions with Canadian and American stock exchanges

Day traders require immediate access to real-time data. With the Trade Ideas Pro stock screener, you get that. The technology scans hundreds of trade opportunities using technical, fundamental, and social data, powered by a high-end artificial intelligence machine, to swiftly identify those with the most significant upside potential. Our selection for the finest stock screener for day trading is Trade Ideas because of this.

In response to the rising demand for DIY investing, a group of financial technology entrepreneurs created Trade Ideas in 2003. They have developed a server-based system that connects directly to the exchanges and tracks every traded stock and ETF. Every tick is examined and tested, allowing for real-time comparison of a security’s behavior to its historical patterns. Day traders require that kind of advantage.

The stock screener uses cutting-edge automated trading tools and many filters for backtesting. Traders might employ preset layouts to get off to a good start. With greater practice, traders can decide to add their own criteria to their screens.

Additionally, traders have access to simultaneous charts, a live trading room, and real-time streaming trade ideas. Trading between virtual and actual markets is made possible by Trade Ideas’ direct connections to online brokerage houses like E-Trade.

TC2000

The TC2000 stock screening package has been improved over more than 25 years, making it the most reliable and potent stock screener available.

Pros

- Easy of use

- Numerous fundamental and technical screening parameters

- Choosing ETFs and options to screen

- Interactive graphs with chart-making instruments

Cons

- Only functions with Canadian and US exchanges

The TC2000 stock screener is as robust and complete as they come, with a good variety of fundamental and technical screening criteria, as well as strong options and exchange-traded fund (ETF) screening. We chose it as the top overall option since its award-winning stock screener was regarded as best-in-class in 1995 and has since outperformed the competition.

Users have the chance to start exploring the possibilities of the Easy Scan stock screener with the entry-level Silver plan. With the Gold and Platinum plans, though, you can unleash its true power. Every plan has a discount when paid for annually.

In the Gold Package, users will get full access to the EasyScan screener, including a straightforward step-by-step wizard for establishing conditions. From the tools for producing charts, users can move into watchlists that can establish up to 100 alerts for simultaneous tracking and are sortable.

The Platinum plan includes additional features including historical condition testing, automated refresh intervals on scans, and sorting with up to a thousand concurrently trackable alerts. If Platinum users join a TC2000 trading account, they can save up to $300 each year.

The strength and resilience of its screening, scanning, and filtering are concealed by how simple it is to operate. You can seamlessly transition from screening on a variety of fundamental and technical screens to managing your watchlists to making trades if you open a TC2000 brokerage account for trading. The same strength and adaptability apply to its screening of ETFs and options.

The fact that TC2000 is only available on exchanges in the US and Canada is its only drawback. Apart from that, it’s challenging to match the potent TC2000 stock screener and its first-rate customer service.

After more than 25 years of refinement, the TC2000 stock screening package is as robust and powerful as you will find, making it our top pick as the best overall stock screener.

FINVIZ

Best stock screeners for US market in swing trading is FINVIZ because it provides the ideal mix of swing trading tools, such as a wide range of fundamental and technical criteria, real-time quotes, charts, backtesting, pre-market data, and email notifications.

Pros

- Very visual screening method

- Simple to use

- A good selection of basic and technical screening requirements

- Access to international stocks

- For many swing traders, the free version is adequate.

Cons

- Fewer basic metrics than the other screeners on this list

Since its creation in 2007, FINVIZ’s stock screener has become a well-liked option for investors. Its extensive toolkit, which includes real-time data, interactive charts, pre-market data, and backtesting utilizing years of historical data, is what sets it apart for swing traders, though. As it’s the greatest stock screen for swing trading so all investors and traders should consider FINVIZ.

Financial visualizations, abbreviated as FINVIZ, refer to the distinctive and captivating ways in which information is presented, making it simple and enjoyable to browse. For instance, users can access a stock’s chart on the screener by merely hovering over the stock symbol. However, the manner in which they loaded their screener with several practical tools and features is their genuine claim to fame. With access to real-time data, sophisticated graphics, pre-market data, personalized filters, and data export features, its Elite screener is a potent research tool.

Its charts are interactive, allowing users to verify a stock’s relative strength indicator or utilize a crosshair cursor to pinpoint precise data points. The performance of a stock can also be contrasted with that of the S&P 500 index. Everything is saved to your portfolio, and the screener supports up to 200 screener presets and 100 different portfolios.

Finviz free plan is available, although the data is not real-time. That might be acceptable if you tend to be a buy-and-hold investor or set up your swing trades before or after the market opens.

TradingView

TradingView competes favorably with all of the stock screeners on this list, but its strength is in the variety of assets it covers, including global equities and funds. Due to this, TradingView is our choice for the top stock screener for international investment.

Pros

- Excellent choice of essential screening parameters

- Wide-ranging charting abilities

- Vast selection of international stocks

- Trial of an interactive trading room for 30 days

Cons

- Limited historical information

TradingView excels as a stock screener because it has a comprehensive selection of economic, financial, and economic screening parameters, as well as its powerful HTML5 charting features. However, what makes it unique is the extensive coverage of foreign equities across more than 130 international exchanges. For this reason, TradingView was selected as the top stock screener for international investment.

An inventive team of traders and software developers came up with TradingView with the goal of building a simple, effective, and widely available trading platform for the general public. TradingView has an unrivaled global presence with more than 30 million active users.

More than 100 fundamental and technical criteria are included in the stock screener, and you may adjust the filters and views to your preferences. One of its distinguishing characteristics is the ability to map and compare economic data with financial indicators of a company to determine how a company has performed in various economic conditions. It’s extremely engaged chat room, which brings together traders from all over the world to exchange ideas, is another noteworthy feature.

With TradingView, you can start screening stocks and ETFs for free, with access to the screener, list alerts, and sophisticated filter customization. Plans that are paid for and offer fuller access to TradingView’s robust features. A 30-day free trial is offered with each paid subscription.

Conclusion

In order to sort through the tens of thousands of equities on the American and international stock exchanges, day traders and stock investors require access to sophisticated data analysis. They require access to excellent stock screeners in order to do that.

The best stock screeners balance flexibility and convenience of use without compromising the quality or amount of the data. The finest screeners include an extensive database of stocks that can be precisely screened using both pre-set and custom criteria. Even for new users, the UI should be simple to understand.

Any stock screener that provides a free service is a good place to start if you’re just getting started in stock selection. Most do, although many of them have very limited abilities. With the Zacks stock screener, which offers you access to hundreds of metrics, that is not the case.

With its best-in-class tools, TC2000’s robust screening, scanning, and filtering software—the greatest overall stock screener—can fit any trading or investment style.

What Is a Stock Screener?

Stock traders and investors use stock screeners as a crucial tool to sort through hundreds of stocks to identify those that best fit their requirements. To reduce their list, users can use any number of filters based on technical and fundamental parameters.

The quicker the screener can find you a match, the more powerful the screening filters should be. To locate a match that is more precise, they can also use their own unique, customized criteria. The screener will immediately show the results in the categories you select after applying the criteria.

Stock screeners are used to find stocks based on various investment scenarios, including developing an asset allocation plan, long-term buy-and-hold methods, or day trading in and out of the market for rapid profit.

How Does a Stock Screener Work?

Stock screeners are comparatively simple. You have to select the filters you want to employ after opening the screener based on specified criteria, such as price, trade volume, price-to-earnings ratio, volatility, chart patterns, and other fundamental or technical metrics. You can add on more filters to further reduce your options until you achieve the desired outcomes.

What Qualities a Stock Screener Should Have?

Searching through the wide universe of stocks to locate the ideal one can initially appear difficult and complicated. A excellent stock screener makes it simple for you to identify the filters you require and begin the process with only a few clicks. Utilizing a stock screener that has a broad selection of filters and allows you to rapidly sort your findings will enable you to drill down even further.

Find a stock screener that best fits your investing approach as well. Others are better suited for long-term investing, while some are better suited for day trading. While some only monitor U.S. stock exchanges, others are global in scope.

Accurate data is another requirement. Always be sure the information is coming from a credible source. Additionally, make sure it can preserve your screens; otherwise, you’ll have to repeatedly enter your criteria.

![You are currently viewing Best Stock Screeners for US Market [2023]](https://contentclap.com/wp-content/uploads/2022/11/Best-Stock-Screeners1.png)